Experts have called for the need to prioritise social finance and development in Africa as Sustainability experts have identified sustainability financial instruments such as green bonds, sustainability bonds, sustainability financing, climate-tagged investment and other dedicated grants and investments put together by national government, private Environmental, Social and Governance (ESG) investors as well foreign investors as a levers to support climate resilience in Africa.

This was made known during a webinar organised by the Sustainability Professionals Institute of Nigeria (SPIN), formerly known as the Association of Sustainability Professionals of Nigeria (ASPN), and sponsored by First Bank of Nigeria, on the theme, “Harnessing Climate Finance Opportunities In Nigeria”.

This is coming on the backdrop of the official commencement of the implementation of the Climate Change Act 2021, following the approval of the workplan for the National Climate Change Council (NCCC) by President Muhammadu Buhari last February, which is expected to provide a sustainable framework for climate-related activities in Nigeria and also underlines the nation’s commitment to the 2060 Net Zero-Target.

In his opening remarks, the Head Sustainability, Media and External Relations, First Bank, and also the Director of Advocacy and Stakeholder Relations, SPIN, Ismail Omamagbe, asserted that the Sustainability Professionals Institute of Nigeria (SPIN), which was formerly known as the Association of Sustainability Professionals of Nigeria (ASPN), is a platform that promotes the practice and profession of sustainability in line with global-best practice of sustainability in Nigeria, committed to working with all the sustainability professionals and organisations with a goal to deepen, mainstream and complement sustainability practices in the country through standardisation, networking, certification, research and advocacy.

The keynote speaker, Obi Ugochukwu, Managing Partner, GCA Capital Partners, opined that in terms of organising domestic resources, the draft of the NDC, which outlines the targets and measures that represents Nigeria’s contribution to global climate change and also redrafted in 2021 with improved targets; the Medium-Term National Development Plan; the Energy Transition Plan; the Long-Term Vision Plan; and the recent commitment to set up the climate change fund by the banker’s committee, make up the key milestones of Nigeria’s commitment to climate action.

It was estimated that Nigeria needs about Three Hundred and Forty-eight trillion Naira to fund its climate change action, and 86% of this funding is expected to be generated from private sector participation.

This puts the spotlight on investment policy, mindset towards climate action and the public–private partnership (PPP) synergy in the evolving climate finance space.

According to Carina Dunker, Director, Green Finance Intergovernmental Panel, Climate Change, IPC, Germany, Climate finance envelopes finance activities tailored towards climate action.

Could be adaptation/mitigation or even a confluence aimed at impacting climate change.

Measuring progress through target metrics is equally as important when discussing climate finance and development.

Emmanuel Etaderhi, Executive Secretary, Finance Center for Sustainability, Lagos, postulated that in future all finance will be sustainable finance, which he described as Green, Social and Sustainability-linked (GSS) financing. This essentially merges all the components into sustainable finance.

This has become a necessity as the world is amplifying efforts towards living sustainably and not limiting the living standards of the future generations.

Olusegun Alebiosu, Executive Director and Chief Risk Officer, First Bank, harped on the need to embrace sustainability as it ultimately improves the quality of our lives as humans, protects the general ecosystem and preserves natural resources for future generations.

He added climate finance can come from very different sources such as public or private, national or international, bilateral or multilateral.

Michael Bensor, a representative of the National Council for Climate Change, opined that the United Nations Framework Convention on Climate Change (UNFCCC) expanded the meaning of climate finance to include technology transfer from one component to the other.

This is a shift from the conventional monetary transactions or bonds in carrying out climate actions that have actual impact on the beneficiary.

Gbemi Akinsipe, Research and Communications Associate, Nigeria Energy Transition Office, asserted on the urgent need for a revolution in data thinking especially in the Nigerian polity where there is increasing data dependency and heightened conversations on data accuracy and measurements.

She noted that data credibility for climate financing is also a necessity.

Africa currently sits between becoming the highest beneficiary or biggest losers in the global climate conversation following her level of vulnerability and high mineral deposits, especially coal which greatly affects the climate and the lack of required funding for alternative sources of energy and implementation framework to power her climate resilience.

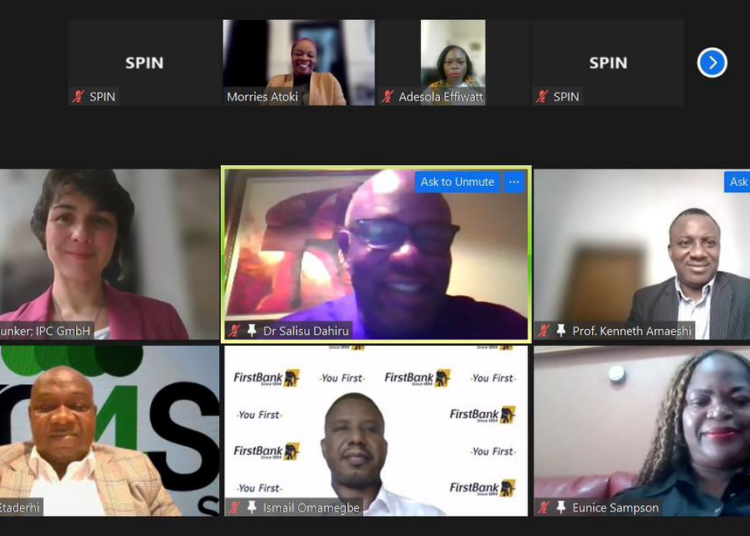

The webinar also had in attendance Eunice Sampson, Director, Climate Change & Sustainability, EY West Africa; Adesola Effiwatt, Principal Scientific Officer, Department of Climate Change, FMENV; Dr. Salisu Dahiru, Pioneer Director General and Chief Executive Officer, National Council on Climate Change (NCCC); Godson Ikiebey, Manager, Sustainability and Climate Change, PwC Nigeria.

The panel session was moderated by Prof. Kenneth Amaeshi, President, Sustainability Professionals Institute of Nigeria (SPIN); while Dr. Mories Atoki, CEO, African Business Coalition for Health and Board Secretary, and Head of Legal Directorate, SPIN, played host among other dignitaries.